Immediate financial losses for Eurozone governments manageable

Although a deal on Sunday remains our base case, the risk of a Grexit is clearly very high. On economic grounds, Grexit should not be the preferred route for either Greece or its Eurozone creditors. There are three main sources of potential damage for creditors:

- there is short-term economic damage throughout the eurozone as confidence likely gets hurt and a period of uncertainty follows, prompting investments to be postponed and consumers to exercise caution;

- there is long-term damage to the credibility of the euro as it turns out to be reversible after all. This damage may not manifest itself until the next major economic or financial crisis. But when such a crisis hits, it will be much more difficult to soothe financial markets with a commitment to do “whatever it takesâ€, as ECB-President Draghi successfully did in 2012;

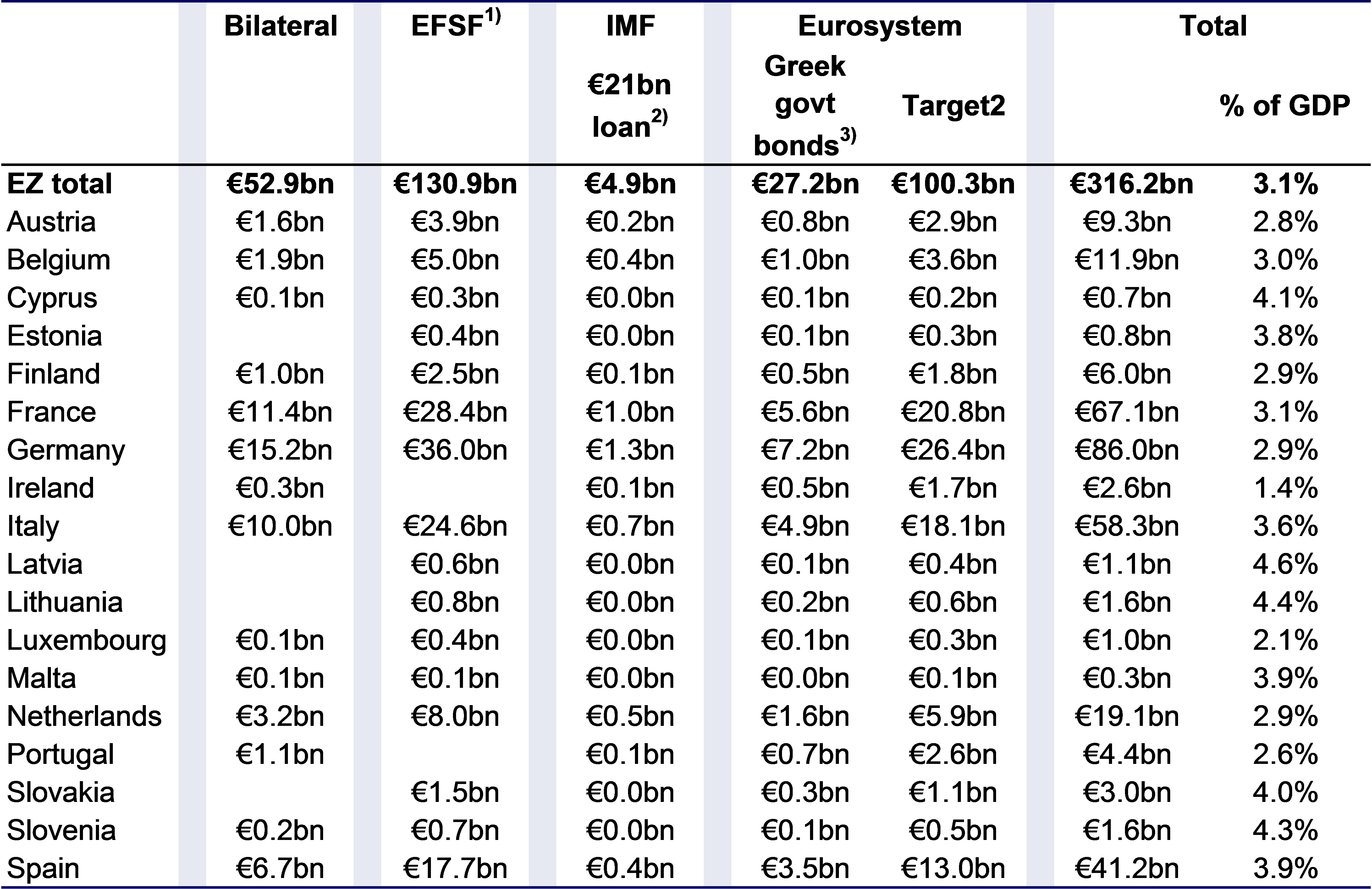

- there are potential financial losses to stomach. Greek debt is unsustainable in any scenario, but in case of a Grexit creditors probably need to write off more, for both economic and political reasons. We refrain from estimating expected losses, but restrict ourselves here to setting out total current exposures to Greece in the table below.

1) EFSF-bonds are 165% overcollateralised, however maximum losses should not exceed 100% of EFSF exposure to Greece provided all guarantors pay up. 2) Losses on the €21bn IMF-loan are shared among IMF-member countries worldwide. 3) Actual Greek government bonds holdings per national central bank are unknown. Holdings are allocated to countries using their respective capital keys.

Source: Bloomberg, Macrobond, ECB, IMF, EFSF, Algemene Rekenkamer, ING-calculations

Total current Eurozone exposure in case of Grexit amounts to €316bn. This consists of bilateral loans, loans by the EFSF that are guaranteed by Eurozone sovereigns, and loans by the IMF. Furthermore, sovereigns are exposed to Greece through their national central banks. These hold a remaining €27bn of Greek government bonds, both directly and through the ECB’s Securities Markets Programme. Moreover, the Bank of Greece currently has a Target2-deficit of €100bn with the rest of the Eurosystem. In case of a Grexit, this becomes a Eurosystem claim on the Bank of Greece that the latter may be unable or unwilling to fulfil. Normal Eurosystem-loans and Emergency Liquidity Assistance (ELA) to Greek banks run through the Bank of Greece, and are not included in this table. The Bank of Greece’s Target2-deficit largely reflects these loans and ELA.

Eurozone governments will not immediately feel the consequences of these exposures in case of a Grexit. Firstly, it remains to be seen to what extent these exposures actually need to be written off. A lengthy negotiation process would likely follow Grexit to settle Greek outstanding government debts. Furthermore, bilateral loans and EFSF-loans are not due before 2023. Losses on these loans will therefore not materialise before then. Losses on IMF-loans will also not directly result in an obligation for IMF-member countries (including Eurozone sovereigns) to recapitalise the IMF. This leaves exposure through the Eurosystem, which is 40% of the total €316bn. To avoid doubts about its ability to conduct monetary policy, the Eurosystem might ask for immediate recapitalisation should its exposure prove difficult to recover in the foreseeable future.