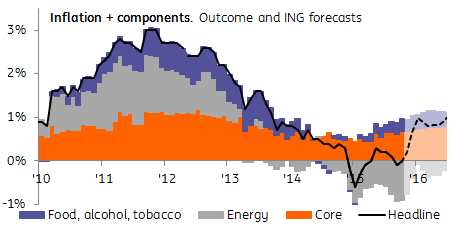

Eurozone headline inflation crept back up to 0.0%YoY in October, from -0.1%YoY last month. Oil continues to keep a lid on inflation. Today’s Eurostat flash estimate also shows core inflation at 1.0% (from 0.9% last month). Services inflation, the best gauge of domestically generated inflation pressures available at this stage, increased 0.1%-point to 1.3%YoY.

Today’s inflation figures are the first indication of price developments after Draghi last week worried about the “strength and persistence of the factors that are currently slowing the return of inflation to levels below, but close to, 2%â€. These worries were his main justification for effectively pre-announcing more monetary fireworks in December.

But it is hard to find justification for the ECB’s apparently increasing worries in today’s inflation figures. Aside from headline inflation, which this year has been driven primarily by oil, services inflation has been moving sideways this year. Core inflation has even crept up rather than down, now trending around 0.9% versus 0.7% a year ago.

To be fair, Draghi’s worries concern the medium term. But even then, it is hard to escape the notion that inflation was merely an excuse to talk down the euro exchange rate last week. The Eurozone is adding jobs at a decent pace and wage growth in the first half of the year reached 1.8%YoY, suggesting that core inflation will trend up rather than down in the medium term.

Draghi’s inflation anxiety seems even more odd given his own comment, made in June 2013, that low inflation “is not, by itself, bad; with low inflation, you can buy more stuffâ€. This certainly applies today: with healthy Eurozone nominal wage growth and inflation around zero, real wage growth is now higher than in the run-up to 2008. The strength of Eurozone domestic demand is therefore in no small part attributable to the current low inflation environment.

Looking ahead, we expect inflation to remain around current levels for another month or two. After that, energy will become a less important factor for headline inflation due to ‘base effects’ (consumer energy prices started their steep decent last December). That should cause headline inflation to quickly recover to between 0.5% and 1.0%YoY, weakening somewhat the tailwind for household consumption.