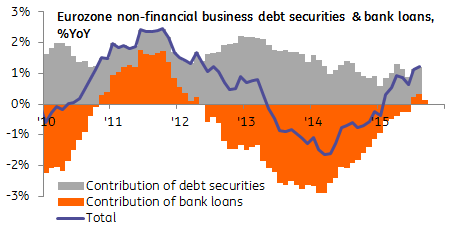

Bank lending to Eurozone businesses fell back in September to 0.1%YoY, down from 0.4%YoY in August (net bank lending adjusted for sales and securitisation). This is disappointing: business borrowing had just turned positive a few months ago after three years of deleveraging. The weakening of business borrowing growth seems at odds with the continuing positive signals sent by soft indicators such as PMIs and last week’s Bank Lending Survey, where banks reported increasing demand for business loans. Chances are therefore that we are looking at a blip, and an upward trend will resume shortly.

In any case, the failure of bank business lending to accelerate looks less bad if one takes into account that bond issuance has been resilient this year. Taking bank lending and bond issuance together, the credit flow to non-financial business turned positive at the start of this year and remains on an upward trend:

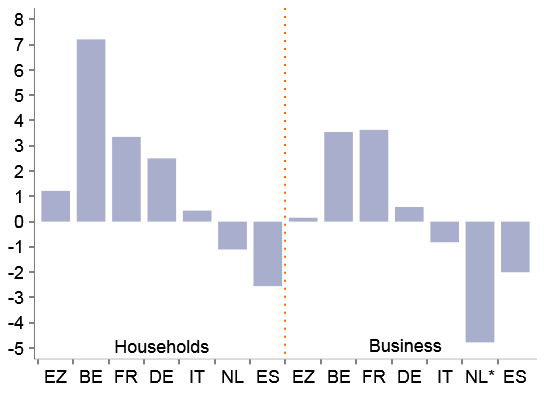

Bank lending to households continued to accelerate. Low rates, solid consumer confidence and housing optimism underpin mortgage lending in many Eurozone countries. That said, credit developments continue to diverge markedly between countries. France and Belgium are seeing solid credit growth to both businesses and households. Developments in Germany are more moderate, although bank lending to households is gathering momentum. Net bank lending in the Netherlands is still negative, although housing optimism has returned (the strongly negative reading in business borrowing is almost certainly a glitch as this series is rather volatile month-on-month in the Netherlands). In Portugal, Spain and Ireland, deleveraging is still in full swing. In Italy however, deleveraging is slowly drawing to a close.

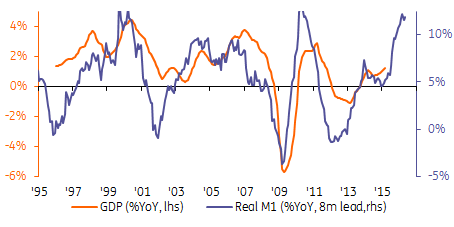

Meanwhile, M1-growth is holding well at over 11%YoY. M1 is one of the best leading indicators of the Eurozone business cycle, and its ongoing strength suggests that current consumption growth could well extend in the quarters ahead:

Overall, this M3-report shows a slowly but steadily improving credit environment in the Eurozone. The faltering of bank credit to non-financial business is an important dissonant however, one not (yet) mirrored in other indicators. This may be a glitch, so we’ll be closely watching next month. In any case, it seems difficult to point at this report, with its strong M1-growth, as convincing justification for further monetary easing in December. For that, ECB-president Draghi will have to look elsewhere.