Eurozone bank lending growth is clearly alive, but kicking only very gently. The perfect data release for the ECB, a few hours before it is expected to announce its tapering plans.

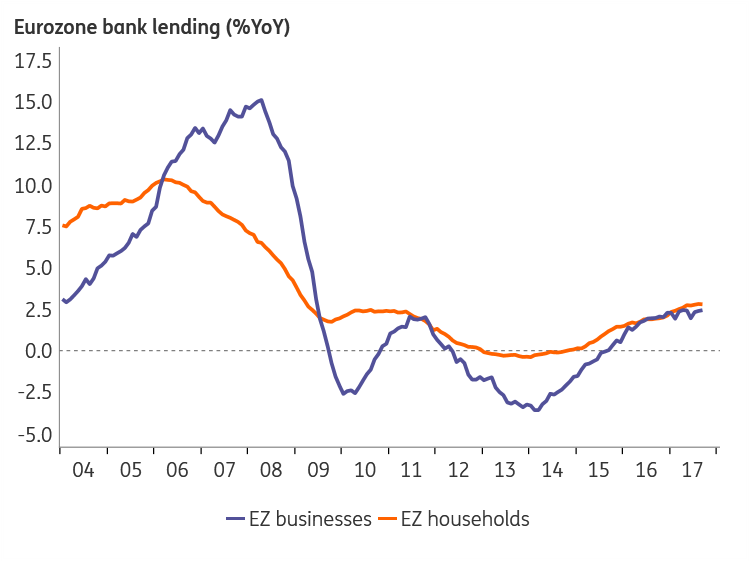

As markets are preparing for what could be the most exciting ECB press conference of the year, later today, the ECB released one last important set of data this morning, on monetary and credit developments in the Eurozone. On this front, things are moving along steadily. Bank lending to households was stable at 2.7%YoY in September, with lending to non-financial businesses ticking up slightly to 2.5% from 2.4%.

This basically means that bank credit will not be an issue for Draghi this afternoon. The ECB-president can convincingly argue that he has jolted bank lending back to life with QE, TLTRO and negative rates. Back in early 2014, households and businesses were, in net terms, paying off bank loans. But those days of deleveraging appear long off today – at least, for the Eurozone as a whole. Bank lending has been recovering slowly but very steadily over the past two years. To be fair, bank lending growth is still negative in Spain, Portugal, Ireland, Greece and the Netherlands. But in most of these countries, the growth rate is slowly turning less negative. So it may not yet be “mission accomplished†here, but the ECB can certainly claim that its policies have helped to mend bank lending markets, and that things are moving in the right direction.

At the same time, the ECB’s unconventional policies have not led to an outright lending boom. Sure, bank lending growth rates looks a bit exuberant in Belgium (6.8%YoY for households and 8.7% for businesses), and to a lesser extent in France (6.2% for households, 5.5% for businesses). But these growth rates remain single-digit and do not appear to forebode the imminent popping of a bubble. So in sum, monetary and credit developments do not provide any reason to slam the brakes.

In sum, today’s monetary and credit data enables a gentle “lower for longer†tapering message. We expect the ECB to lower monthly purchases to €25bn while extending them to year-end 2018. At the same time, lack of a credit boom creates room for Draghi to signal that rates will remain low beyond 2018.