De geldscheppingsparadoxGeldschepping is een belangrijke maatschappelijke taak, uitgevoerd door vooral private banken. Sinds de financiële crisis gaan er stemmen op om deze taak bij de banken weg te halen (o.a. Martin Wolf en Sustainable Finance Lab).Dit zou een radicale verandering van het financiële stelsel zijn waarvan we de gevolgen niet goed kunnen overzien. Het is beter om de in gang gezette verbeteringen een kans te geven dan om nu radicale, ongeteste oplossingen in te voeren. Lees de volledige post op Me Judice. De uitgebreide analyse die aan deze opinie ten grondslag ligt is hier te vinden.

Kan bitcoin ooit echt geld worden?

Er is iets nieuws in geldland: bitcoin. Bitcoin en andere “cryptovaluta’s” bieden een alternatief voor traditionele valuta’s en betaalsystemen. Maar kunnen cryptovaluta’s geld echt vervangen?

Geld heeft drie kenmerken. Het is

- een ruilmiddel;

- een rekeneenheid, en

- een oppotmiddel.

Aan het eerste kenmerk kunnen cryptovaluta’s in de toekomst voldoen, als ze breder geaccepteerd worden. Het tweede en derde kenmerk zijn lastiger, omdat de waarde van bitcoin nogal fluctueert. De waarde vertienvoudigde in 2013, maar bitcoin heeft ook al een paar speculatieve crises gehad.

Bij echt geld dempen centrale banken deze fluctuaties door de geldhoeveelheid en prijzen te reguleren via de rente. Maar het is nu juist het doel van bitcoin en andere cryptovaluta’s om centrale autoriteiten overbodig te maken. De hoeveelheid bitcoins neemt in een vaststaand tempo toe door “mining”. Maar de vraag naar bitcoin varieert natuurlijk gewoon. Hierdoor fluctueren de prijs van bitcoin en de wisselkoers t.o.v. de dollar en de euro.

Deze fluctuaties konden wel eens bitcoin’s Achilleshiel zijn omdat ze een rol als echt geld moeilijk maken. Er is een uitweg: een bitcoin-formule die de geldhoeveelheid automatisch soepel afstemt op de vraag. Het is niet onmogelijk, maar die formule zou zo baanbrekend zijn dat de uitvinders ervan direct in aanmerking zouden komen voor de Nobelprijs in de Economie.

Are the seven lean years over?

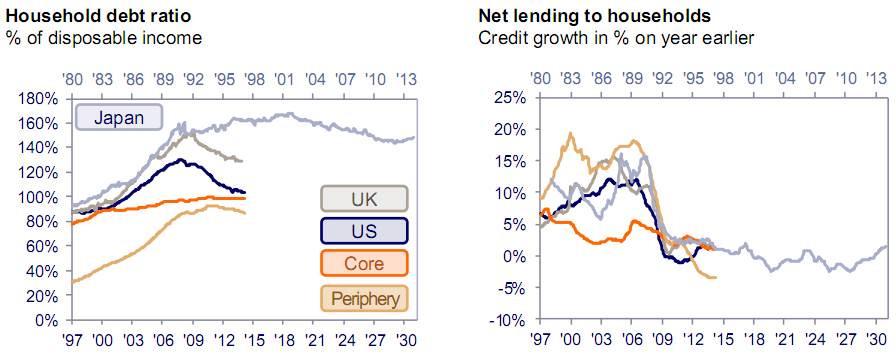

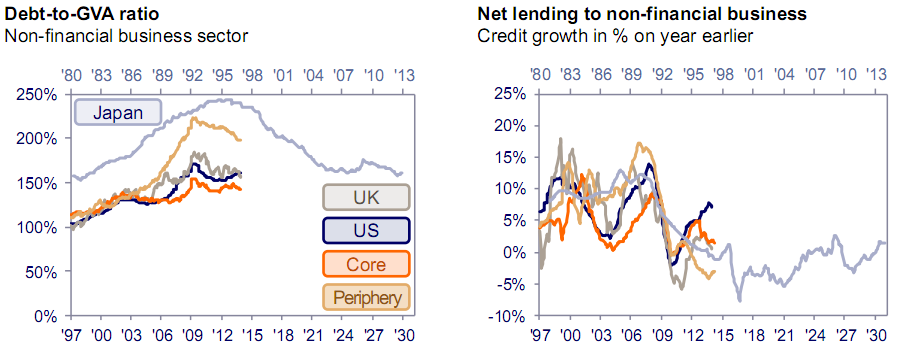

The US, the UK and the euro area are now in the seventh year following the financial crisis. Are the seven lean years over, financially speaking? This is the question I seek to answer in this report. Here are the main conclusions:

- In both the household and non-financial business sectors, only the Eurozone periphery is actually reducing debt. The US, UK and euro area core are deleveraging by growing income. In the Eurozone periphery however income is stagnating.

- The US, UK and Eurozone core compare favourably with Japan in the 1990s, where household debt ratios stagnated and business deleveraging was slow. Especially in the Eurozone periphery business sector, deleveraging may not be over.

Japan on upper time scale, UK/US/Eurozone on lower time scale. GVA = gross value added.

- Deleveraging however does not preclude growth. This is important especially for the Eurozone periphery.

- Corporate debt issuance has partly compensated for the slowdown in bank lending and stagnation of securitisation in most countries. But banks still account for over half to two-thirds of credit outstanding in Europe. This figure is less than one-third in the US

Have a look at the whole report (its 18 slides make it easy to digest) and let me know what you think!

Surprise leap in US new home sales; home prices slowing down

US new home sales jumped 18.6% in May to 504k, well above the consensus. May sales are also 16.9% higher than a year ago. This upward surprise may be a late winter catch-up effect. New home sales were clearly below trend in February to April. But including May, average sales since February are 443k, which is closely in line with sales in the latter half of 2013. Our working hypothesis therefore is that May’s jump is a one-off, and sales will likely revert to the pre-winter 440-460k range next month.

Earlier today, the April Case-Shiller 20-City home price index decelerated markedly. Prices increased 0.2%MoM (sa), well below the 0.9% average monthly price rise we have seen in recent months. Prices are now up 10.8% over a year ago, down from 12.4% last month.

We have been expecting upward price pressures to diminish for some time now, given the slowdown in sales. But today’s 0.2% looks like an undershoot of the trend. That is probably at least partly a correction of last month’s surprisingly strong 1.3%MoM increase. We may be looking at some seasonal adjustment issues here. That said, a further slowdown of home prices in the coming months is likely as existing home sales are 5% lower than a year ago, even after yesterday’s uptick. But the still limited supply of existing homes for sale, 5.3 months right now versus a long-term average of 6.5, will ensure that prices will not weaken substantially.

Eindelijk weer meer banen in VS dan voor de crisis

US non-farm payrolls rose by 217k in May, very close to consensus. Still, this is a bit of a relief, as earlier indicators this week on balance pointed towards some downward risk. This is the fourth month in a row with job growth above 200k. This includes the winter bounce back, however. Average job growth over the past 6 months is 192k, which is a continuation of the trend growth seen since early 2011. A major hallmark today is that the total number of jobs finally rose above the pre-crisis peak of 138.4m jobs reached in January 2008.

Unemployment held steady at 6.3%, which is a modest positive surprise. Given the strong 0.4% drop in unemployment last month, we did not exclude an upward correction today. The inactive-to-total-population ratio among the key 25-54 age group did worsen slightly from 23.5% last month to 23.6% in May, but other broad measures of participation remained unchanged.

In total, this is a solid report showing the continuing gradual improvement of the US labour market. Given this ongoing improvement and the low level of unemployment, wage growth has been unusually lacklustre for some time now. Today does not change that picture. Wages increased 0.2%MoM, but are still up only 2.1% over a year ago, which has been average wage growth for several years. There simply is no evidence of wage inflation yet. Consequently, we see little likelihood that the Fed will deviate from their established $10bn per meeting taper pace at the upcoming FOMC-meeting (18-19 June).

The money creation paradox: banks create money, but also have to borrow it

Banks create money out of nothing, but an individual bank doesn’t. This is the money creation paradox, and it helps to explain many common misunderstandings about money and monetary policy. While it is true that bank deposits, which these days dominate the money supply, are created in the process of banks making loans, it is not true that they can be created without restraint.

So what explains the money creation paradox? The key is to recognise that an individual bank, when it makes a loan, doesn’t usually retain the associated bank deposit. The borrower typically uses the loan to buy something from someone else, who will deposit the proceeds in their bank, which typically will be another bank. The lending bank therefore has to ensure that it can fund the loan. So while banks as a whole create money ‘out of nothing’ by making loans which result in the corresponding deposits which contribute to the supply of money, every individual bank still has to compete to secure the deposits that are backing their loans, or else borrow the money, raise capital or sell other assets. At the same time, they also have reconcile their profit goals with prudent levels of risk, capital and liquidity.

This narrative runs counter to the story typically told by many economists, who gloss over the distinction between the behaviour of the banking system as a whole and that of individual banks. In their simplified world, it’s as if the system consists of a single bank (now there’s one that’s too big to fail!). Such a Megabank would indeed be able to create money out of nothing, since its loans would automatically be matched by the deposits credited to its borrowers.

The usual line of thinking leads to the idea that banks can create money without restraint. In the wake of the financial crisis, it is then a small step to assert that banks can’t be trusted with money creation. Yet the money creation paradox highlights the fact that banks can’t create money without restraint, and that other players in the system also affect the outcome, creating and destroying money.

Indeed, the central banks have a big role to play in the money creation process. They influence the money supply by setting interest rates, which affect the volume of bank lending and deposit creation by banks. Yet the financial crisis has forced the central banks to move beyond a reliance on interest rates to set the monetary climate. With official interest rates having been cut to zero, or as near as practically possible, they have had to look for other tools. Enter ‘quantitative easing’: the central banks in the developed world have moved directly into the money creation business. Central banks are buying assets, such as bonds, in a big way. To the extent that these are drawn from outside the banking system, the central banks increase money supply by boosting the bank deposits of the investors who are selling the assets.

The problem is that the central banks efforts to boost the money supply through quantitative easing have to contend not just with the behaviour of the banks, but also the banks’ customers. The money supply also depends on the customers’ demand for it. If they don’t wish to hold the deposits that are created by sales of assets to the central bank, or loans that banks are making to them, then there is nothing to stop them ‘destroying’ money by, say, buying bonds from banks or simply repaying their loans. In effect, for all the attempts by the central banks to set the monetary climate, the monetary weather is set by the banks’ and customers’ desire to create and hold deposits.

The money creation paradox reveals why criticism of the banks for creating too much, or too little money, is misguided: the money supply is not determined by banks alone. Instead, the key question about the banks’ role in money creation should be about a counterpart of money creation, namely lending. Shouldn’t we be more concerned about the quality of the loans and other assets that the banks are holding to back their depositors’ money? After all, financial crises tend to arise not from bank-created money cycles but from credit-fuelled booms and bust in asset prices. Regulatory tightening and a renewed focus on macroprudential supervision has already gone a long way to addressing concerns about bank lending.

But turning attention to bank lending highlights the fact that banks are not the only providers of credit. Non-bank credit, be it other non-bank financial institutions or capital markets, already play a major role and may become more important as banks are encouraged to de-risk further. This brings us to another paradox: those who worry about bank’s money creation may be looking both at the wrong side of the balance sheet and at the wrong institutions.

Read The Money Creation Paradox for more (note: updated and refreshed in May 2018).

US housing starts surprise on the upside – or do they?

While moderate increases were expected, both US housing starts and permits improved much more than expected. For both starts and permits however, this was all due to double-digit month-on-month improvements in the volatile multi-family segments. We prefer to concentrate on the more reliable single-family segment. Single-family starts edged up 0.8%MoM. Not stellar, but definitely not bad either: This is still 9.8% up from a year ago.

Single-family permits best reflect homebuilders’ expectations for the near future. They increased by 0.3%MoM to 602k (saar), which is lower than the trend before the bad winter weather hit, and also slightly (3.2%) lower than a year ago. Housing demand has proven not to be immune to the effects of higher mortgage rates and price hikes on housing affordability.

The adjustment to higher mortgage interest rates — or more accurately, to the end of the ultra-low rates era — is well underway now. Mortgage applications for house purchases, an early yet volatile indicator of housing demand, fell sharply in the second half of 2013 but seems to have stabilised since the beginning of this year. This suggests that the correction in sales and construction should be mostly behind us now. This is broadly in line with yesterday’s NAHB homebuilder sentiment survey. Although builders reported a further slippage in sales this month, they also saw a slight pickup in the number of prospective buyers.

We expect the housing market to show further signs of stabilisation in the coming months. The housing market may not be the buoyant growth engine that it was last year, but we do not expect it to provide credible reason for the Fed to delay tapering or postpone interest rate hikes either.

Draghi bezorgd over eurovisie

In ING Markten in beweging van deze week:

- De ECB maakt zich serieus zorgen over de sterke euro, die de export kan afremmen en de toch al lage inflatie verder kan dempen. ECB-president Draghi hintte sterk op actie komende maand.

- Komende week blijkt waarschijnlijk dat de Europese economie in het eerste kwartaal heel behoorlijk gegroeid is. De vraag is vooral in hoeverre dit zich doorzet.

- In Focus: robotisering biedt vooral kansen voor Nederland. De Nederlander verwacht verandering op de arbeidsmarkt en durft deze aan.

Lees de volledig publicatie hier.